Fixed-Rate vs. Adjustable-Rate Construction Loans: Pros and Cons

When planning to build your dream home, one of the most important decisions is choosing the right type of construction loans. Among the key choices is whether to go with a fixed-rate or an adjustable-rate construction loan. Understanding the differences, advantages, and potential risks can save you money and stress throughout the building process.

Content

What Is a Fixed-Rate Construction Loan?

A fixed-rate construction loan locks in a single interest rate for the entire construction period. This means your monthly payments remain predictable, even if market interest rates fluctuate. Fixed-rate loans are ideal for homeowners who value stability and want to avoid surprises during the building process.

Advantages of Fixed-Rate Loans:

- Predictable monthly payments for budgeting.

- Protection from rising interest rates.

- Simplifies financial planning during construction.

Disadvantages:

- Typically higher initial interest rates than adjustable-rate loans.

- Less flexibility if interest rates decrease in the future.

What Is an Adjustable-Rate Construction Loan?

An adjustable-rate construction loan (ARCL) has an interest rate that changes over time, usually tied to a financial index such as the prime rate. These loans often start with a lower initial rate, which can increase or decrease periodically throughout the construction period.

Advantages of Adjustable-Rate Loans:

- Lower initial interest rates, which can reduce short-term payments.

- Potential for savings if market rates decrease.

- Often easier to qualify for due to lower initial payments.

Disadvantages:

- Monthly payments may increase if interest rates rise.

- Less predictable budgeting during construction.

- Can become expensive if market rates spike.

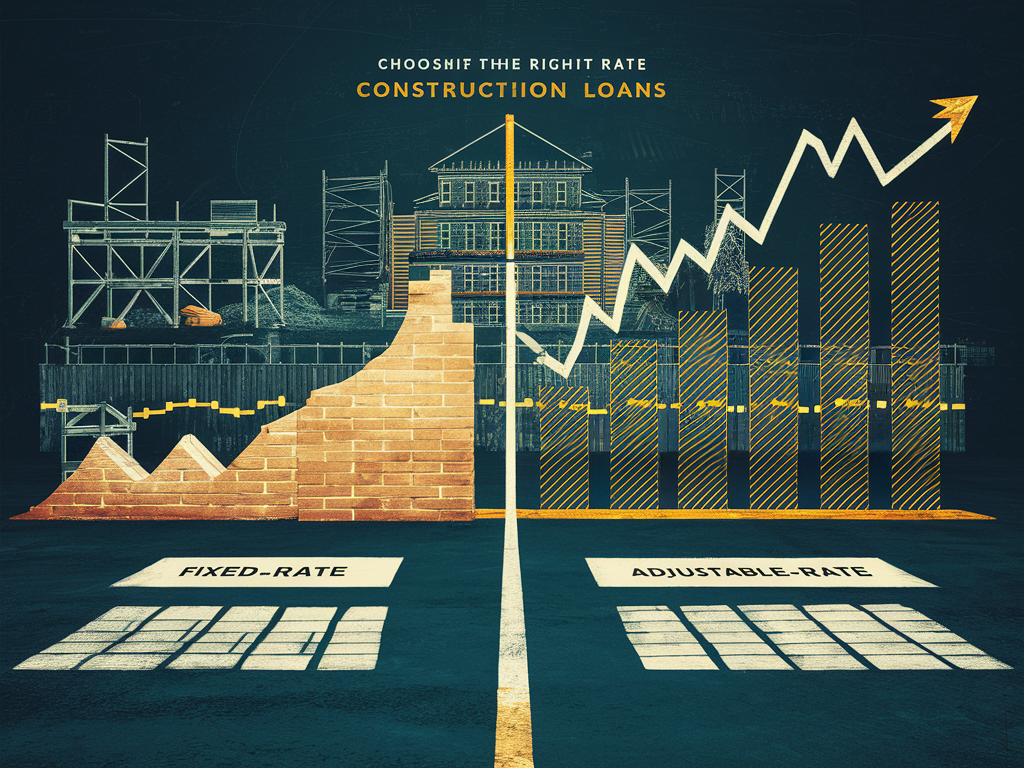

Key Differences Between Fixed-Rate and Adjustable-Rate Construction Loans

| Feature | Fixed-Rate Loan | Adjustable-Rate Loan |

|---|---|---|

| Interest Rate | Locked for full term | Changes periodically |

| Predictability | High | Moderate to low |

| Initial Rate | Usually higher | Usually lower |

| Risk | Low | Higher due to rate fluctuations |

| Best For | Budget-conscious homeowners | Homeowners seeking lower initial payments |

Which Option Is Right for You?

Choosing between a fixed-rate or adjustable-rate construction loan depends on your financial situation, risk tolerance, and market expectations:

- Fixed-Rate Loans: Ideal if you want stable monthly payments and protection from rising interest rates.

- Adjustable-Rate Loans: Suitable for those who can handle potential payment increases and want to take advantage of lower initial rates.

Tip: If you’re building a custom home, consider your construction timeline and how long you expect the loan to last. This can help you decide which rate structure makes the most sense.

Conclusion

Understanding the differences between fixed-rate and adjustable-rate construction loans is essential for smart financial planning during your homebuilding journey. While fixed-rate loans offer stability and predictability, adjustable-rate loans can provide short-term savings but come with some risk. Evaluate your budget, risk tolerance, and project timeline to choose the best option for your dream home.

My name is Wilson Michel. I post about home improvement ideas and how to make your home look beautiful and liveable. I hope my posts will help you with your DIY projects!

Leave a Reply